What is Tokenization in Blockchain? Definition, Benefits and Examples

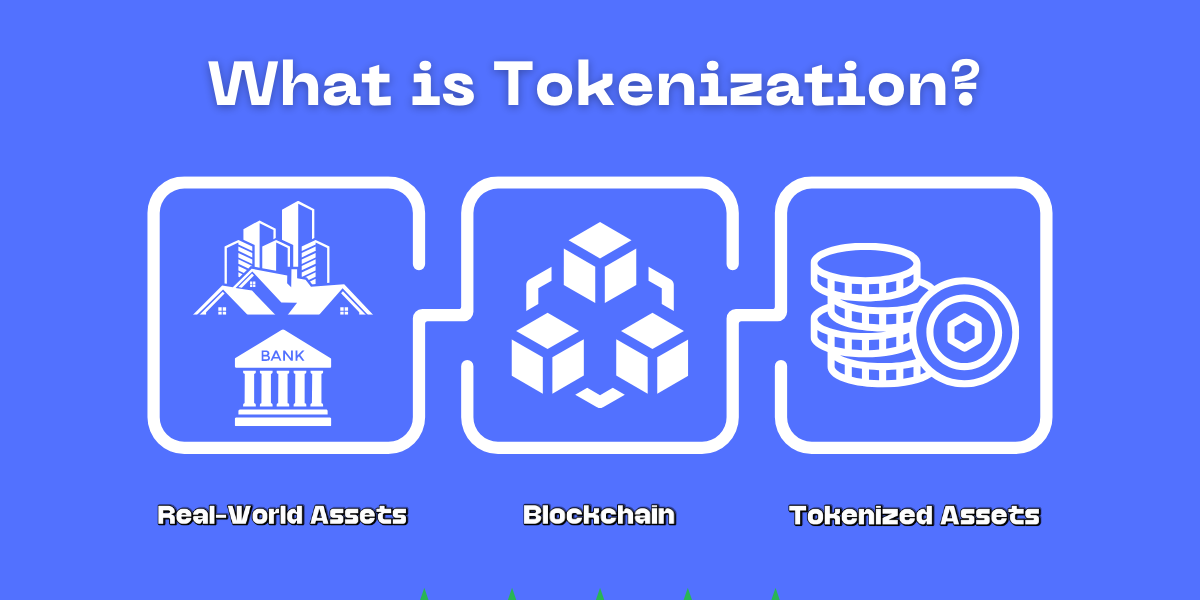

Tokenization is the process of converting the rights to an asset into a digital token on a blockchain network. It involves issuing a blockchain token that digitally represents a real tradable asset. The token acts as a wrapper that allows the underlying asset’s value to be fractured and traded with increased liquidity in the digital marketplace.

In simple terms, tokenization refers to representing real-world assets like fiat currencies, commodities, real estate, art, etc., with tokens on a blockchain. It converts the ownership rights to these assets into digital tokens that can be easily traded and tracked.

The need for tokenization stems from the fact that certain assets like real estate and fine art are quite illiquid in their original form. They typically involve large transaction sizes and elaborate paperwork for buying/selling. Tokenization aims to solve this by "wrapping" these assets into more liquid blockchain-based tokens. Each token becomes a digital representation of ownership in the underlying asset.

For instance, instead of dealing with entire buildings, tokenization can break up a property into smaller blockchain tokens. Each token could represent fractional ownership in that real estate asset. So, instead of needing millions to own real estate, one can purchase and trade real estate tokens worth as low as $10.

Similarly, artwork worth millions can be broken into smaller fractions and converted to digital tokens. These tokens can be easily purchased, held, and traded by investors who otherwise will not have access. The same applies to assets like commodities, fiat currencies, sports teams, business stakes, etc., which can be illiquid or require huge investment amounts.

Key Takeaways:

- Tokenization refers to the process of converting rights to an asset into a digital token on a blockchain.

- It creates digital representations of assets such as real estate, art, commodities, fiat currencies, etc., that can be easily traded on blockchain platforms.

- Tokenization enhances liquidity, enables fractional ownership, widens access to investment opportunities, and simplifies trading.

- It has the potential to disrupt many traditional exchange systems by introducing transparency, automation, and decentralization.

- Popular blockchain platforms used for tokenization include Ethereum, Stellar, Ripple, EOS, etc. The ERC-20 and ERC-721 standards are commonly used.

- Tokenized assets can be traded on decentralized exchanges like Uniswap and traditional platforms like tZero.

- Tokenization could benefit many industries, including real estate, banking, supply chains, intellectual property, gaming, etc.

- It comes with risks like price volatility and poor liquidity, which need to be managed for long-term viability.

- Overall, tokenization is transforming finance and commerce by unlocking the liquidity of previously illiquid assets.

How Does Tokenization Work?

Tokenization involves creating a digital representation of a real-world asset on a blockchain. Here are the main steps involved:

Choosing the Asset

First, the asset that needs to be tokenized is identified. This is usually an asset that suffers from a lack of liquidity, such as real estate, artwork, invoices, commodities, etc. Even assets with existing liquidity, like fiat currencies and securities, can be tokenized to enhance trading opportunities.

Selecting the Blockchain

Next, the blockchain network is chosen to create the tokens and execute the transactions. Popular blockchain platforms used for tokenization include Ethereum, Ripple, Stellar, EOS, NEO, etc. Ethereum is the most common choice due to the availability of standards like ERC-20 and ERC-721.

Creating Smart Contracts

Then, smart contracts are created to define the terms of the token and the rules around its use. These include details like token supply, valuation, ownership transfer, viewing rights, etc.

Minting the Tokens

After the smart contracts are deployed on the blockchain, tokens are minted. The asset ownership rights are fractionalized into these tokens.

Marketing and Trading the Tokens

Finally, the tokens are marketed for purchase by investors globally. Secondary trading takes place on cryptocurrency exchanges. Smart contracts handle ongoing administration, such as record-keeping, compliance, payments, etc.

Benefits and Opportunities of Tokenization

Here are some of the major benefits that tokenization offers:

- Increased Liquidity: Tokenization unlocks liquidity for traditionally illiquid assets like real estate. It splits ownership into smaller, transferable units, allowing more investors to participate.

- Traceability: It makes the assets easily tradable on a global scale through cryptocurrency exchanges and marketplaces.

- Fractional Ownership: Allows fractional ownership of high-value assets, thereby reducing the investment needed by an individual investor.

- 24/7 Markets: Enables 24/7 trading of tokens globally through decentralized exchanges, which are always open.

- Reduced Volatility: It can reduce price volatility compared to investing directly in some assets like commodities.

- Universal Access: Allows anyone worldwide with an internet connection to invest and participate in assets that were previously unavailable.

- Improved Cash Flow: Enables new cash flow opportunities for asset holders through fractional ownership.

- Transparency: All transactions are recorded immutably on the blockchain ledger for full transparency.

- Automation: Smart contracts automate processes like issuance, record-keeping, compliance, payments, etc., reducing manual efforts.

- Speed: Tokenized assets can be traded in near real-time, given the speed of blockchain transactions.

These benefits open up new opportunities across many industries and use cases, some of which are:

- Real estate - Improves liquidity in property markets and enables fractional investing.

- Fine art - Allows common investors to own and trade fractions of rare collectibles.

- Banking - Digitizes assets like fiat currencies, bonds, and securities to enhance trading.

- Supply chain - Tokenizes goods and materials to simplify logistics management.

- Intellectual property - Helps creators monetize and protect ownership rights.

- Gaming - Virtual assets like in-game items can be tokenized for trading.

- Fan tokens - Gives fans fractional ownership in teams/leagues.

As evident, tokenization is extremely versatile and can add value across many different sectors.

Popular Token Standards Used

While each blockchain has its own native token standard, most tokenization projects use Ethereum and leverage its ERC token standards due to its maturity and ecosystem support.

Some popular token standards include:

ERC-20 – used for fungible assets like currencies, commodities, etc., that are interchangeable. Popular for ICO tokens.

ERC-721 is a non-fungible token standard used for unique digital assets like real estate, art, collectibles, etc. It enables tracking individual tokens.

ERC-884 – standard for tokenized securities on Ethereum. Has inbuilt compliance protocols.

ERC-1155 – enables both fungible and non-fungible tokens in a single smart contract. Gas-efficient.

These standardized approaches allow interoperability between various applications and services in the Ethereum ecosystem.

Beyond Ethereum, other blockchain platforms like Stellar, Ripple, EOS, etc., also have their native token standards similar to ERC-20 and ERC-721.

Platforms for Buying/Trading Tokenized Assets

Some platforms that allow investing in tokenized assets include:

- Uniswap – Decentralized trading protocol for swapping Ethereum tokens

- OpenSea – Biggest NFT marketplace for buying/selling crypto collectibles

- RareBits – ERC-721 marketplace for trading crypto assets

- tZero – SEC-approved exchange for trading tokenized securities

- Bitshares – Decentralized exchange supporting asset tokenization

- Bancor – On-chain liquidity protocol enabling token trading

- Waves – Blockchain-based platform for various digital assets

Both centralized and decentralized exchanges are emerging around tokenized assets. While decentralized platforms like Uniswap provide greater transparency and control to traders, regulated centralized platforms also play an important role currently in widening access.

Challenges and Risks of Tokenization

While tokenization unlocks several opportunities, it also comes with a few challenges:

- Illiquidity – Low trading volumes for certain fractionalized assets can limit liquidity.

- Volatility – Speculation can result in major price swings for some tokenized assets.

- Regulation – Lack of clear regulations, especially for tokenized securities.

- Cyber risks – Vulnerability to the hacking of token smart contracts and wallets.

- Scams – Fake token projects can defraud uninformed investors.

- Compliance – Challenges in complying with KYC/AML regulations on public blockchains.

- Technology – Technical risks like failed transactions, bugs, etc., that disrupt trading.

While the blockchain technology foundations are maturing and gaining mainstream traction, asset tokenization is still a relatively new domain. Wider participation from financial intermediaries, regulators, platforms, and users is needed to address the risks and challenges.

As the supporting institutional infrastructure evolves, tokenized assets are likely to become less volatile and more widely accessible. Ongoing technology innovation around decentralized finance and non-fungible tokens also promises to provide better safeguards and compliance mechanisms.

Real-World Examples of Tokenization

Here are some real-world examples that illustrate the potential use cases of asset tokenization:

Fine Art –

- Maecenas is a blockchain platform that converts artworks into ERC-20 tokens. It allows investors to buy and trade fractional ownership in expensive paintings.

- Codex provides a decentralized registry for unique art pieces and antiques. It enables provenance tracking and transfers of rare collectibles.

Real Estate –

- AssetBlock tokenizes commercial real estate properties like hotels, offices, and warehouses using the ERC-20 standard. Investors can buy and trade the tokens online.

- RealT digitizes property ownership in Detroit, US, by representing titles through tokens on the Ethereum blockchain. This improves liquidity and governance.

Commodities -

- MineHub enables supply chain tokenization for enterprises in metals and mining. It brings accountability to materials trading between miners, traders, buyers, etc.

- VNX provides a platform for tokenizing commodities like precious metals, energy, and agriculture. Token holders receive entitlements to the physical assets.

Equity Capital –

- NeuFund offers automated solutions to perform share tokenization. This converts traditional securities into digital tokens to streamline trading compliance and shareholder communication.

- Tokeny’s T-REX platform enables issuers to tokenize shares and bonds. It makes private securities liquid 24/7.

Fan Tokens -

- Socios launched blockchain-based fan tokens for various sports teams. Holders get voting rights to influence decisions and access exclusive rewards.

- Bitci allows fans to buy player tokens for their favorite teams. These tokens come with associated rights and benefits.

As evident, tokenization brings immense possibilities to unlock value and opportunities in both traditional and emerging domains.

The Future of Tokenization

Looking ahead, here are some future trends around asset tokenization:

- Wider adoption beyond niches like art, crypto, and real estate into mainstream finance.

- Hybrid tokenization models will emerge, combining public blockchains with private ledgers.

- Decentralized autonomous organizations (DAOs) will manage pooled tokenized assets.

- Stablecoins backed by tokenized assets will grow as a unit of account and payments.

- Seamless cross-chain interoperability and atomic swaps between token ecosystems.

- Emergence of decentralized exchanges with shared liquidity pools.

- Integration with traditional banking, financial systems, and regulations.

- Internet-of-things and tokenization will enable new Machine-to-Machine economies.

- Automated smart contract compliance, audits, and reporting to reduce risks.

Final Words

Overall, tokenization is poised to drive the next wave of disintermediation in finance. While still in its early days, it promises to progressively reform the exchange of value across industries, geographies, and income levels. Just like email transformed and democratized communication, tokenized assets can make finance and commerce more open and inclusive in the digital era.

Frequently Asked Questions

Here are some common questions about tokenization:

What is tokenization in blockchain?

Tokenization refers to representing real-world assets like property, art, fiat currencies, etc., with digital tokens on blockchain networks. It converts ownership rights into fractional, tradable blockchain tokens.

What can be tokenized?

Almost anything with tangible or intangible value can be tokenized—real estate, fine art, commodities, securities, fiat money, enterprise assets, intellectual property, personal data, etc. Tokenization can benefit any scarce, unique asset.

How does asset tokenization work?

An asset is chosen and then tokenized on a blockchain using smart contracts defining its value and terms. Investors can then purchase, hold, and trade the tokens on token exchanges. Ownership is recorded immutably, and the asset can be redeemed by burning tokens.

What are the benefits of asset tokenization?

Key benefits are - increased liquidity, fractional ownership, ease of trading globally 24/7, transparency, automation, reduced volatility, universal access to invest in assets, and potential for higher ROI.

What risks are involved with asset tokenization?

Some key risks are technology failures, vulnerabilities to hacking, lack of liquidity, price volatility, regulatory uncertainty, compliance challenges with KYC/AML, money laundering risks, and scam token projects defrauding investors.

Which blockchain platforms enable asset tokenization?

The most popular platforms are Ethereum, Stellar, Ripple, EOS, NEO, etc. Ethereum's ERC standards, ERC-20 and ERC-721, are widely used for tokenization.

Where can I buy and trade tokenized assets?

You can trade tokenized assets on platforms like Uniswap, OpenSea, Bittrex, Bitfinex, Bancor, tZero, etc. - both centralized and decentralized token exchanges.

What is the future of asset tokenization?

Tokenization is expected to grow exponentially and become mainstream across finance in the coming decade. As regulations evolve, asset tokenization can replace many conventional financial markets.

Jinu Arjun

Verified Experienced Content Writer

Verified Experienced Content Writer

Jinu Arjun is an accomplished content writer with over 8+ years of experience in the industry. She currently works as a Content Writer at EncryptInsights.com, where she specializes in crafting engaging and informative content across a wide range of verticals, including Web Security, VPN, Cyber Security, and Technology.